A Strategic Buyer’s Perspective: Quick Hits

Tactics, processes, relationships, timing – the panelists at our first MedTech M&A Series event in partnership with MassMEDIC spoke about these and more from a strategic buyer’s perspective. Executives from Boston Scientific, ZOLL Medical and Draeger sat down (virtually) with MedWorld Advisors’ own Dave Sheppard to share their experiences being at the helm of acquisition activity for their respective companies. Here’s a quick look at some of the main discussion points.

Why MedTech Businesses Are Looking to Sell Now

The medtech M&A market is running hot right now, and for many reasons, it’s a seller’s market. CEO Florence Joffroy-Black and Managing Director Dave Sheppard discussed why right now is great time for medtech companies looking to sell in a recent column for Medical Product Outsourcing Magazine.

Exit Strategy – When to Buy, Sell, Hold, Etc.

With steady M&A activity in the medtech sector, many are wondering — is now is a good time to sell a medtech company? Every business situation is unique, but MedWorld Advisors CEO Florence Joffroy-Black and Managing Director Dave Sheppard discussed some possible scenarios in a recent article published in Today’s Medical Developments Magazine.

Medical Device M&A Activity in 2021 – a Very Active Start to the Year

Activity in the medical device and medtech realms has been picking up steam throughout 2021. Many factors play into the continued growth we see, and the industry looks to keep moving forward. Extra cash on hand lends itself to M&A activity, and industry players are continuing to capitalize on opportunities.

MedTech’s Fit With The Digital Health Niche

The digital health trend has continued to accelerate throughout the global pandemic. Virtual consultations and the transition to telehealth has transformed the state of healthcare as we know it, and this looks likely to only pick up speed in the coming years ahead.

To The Daily Winners In Our Industry…..

Moving forward in 2021 in the medtech industry brings a true appreciation for everyone involved. Whether you are designing products, on the production line, or in the C-suite, you are making a difference every day and we applaud you. It’s not easy to succeed in this business or survive for the long term.

Medtech’s New Normal - C-Suite Challenges

C-Suite Challenges in Medtech’s New Normal

Many of the usual C-Suite management topics that are key to organizational success will remain the same this year.

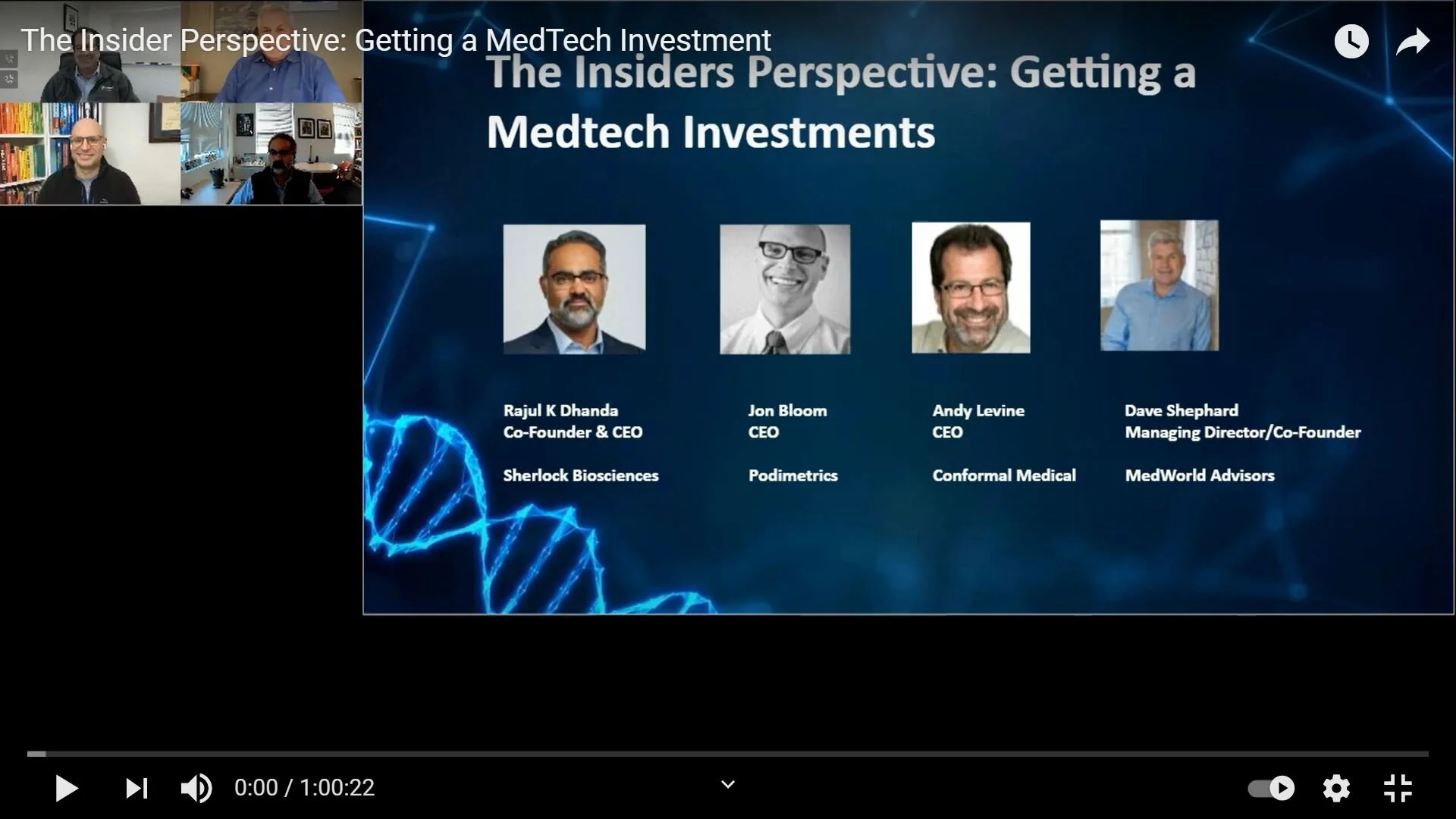

The Insider Perspective: Getting a MedTech Investment

In a webinar hosted by MassMEDIC, MedWorld Advisors Co-Founder and Managing Director Dave Sheppard is joined by three medtech CEOs to discuss the topic of raising money. Jon Bloom, CEO of Podimetrics, Rahul Dhanda, Co-Founder and CEO of Sherlock Biosciences and Andy Levine, CEO of Conformal Medical share their inside perspective on the do's and don'ts of getting investments in the medtech sector.

2021 – Rebuilding our future one device at a time

As we prepare for 2021, do we dare reflect on 2020? Given COVID-19 and political drama, we prefer NOT! There will be books and movies to tell the 2020 story, so we’ll let Hollywood take care of that.

M&A in 2021: What’s Next?

MedWorld CEO Florence Joffroy-Black and Co-Founder Dave Sheppard recently submitted their thoughts on M&A strategies moving forward into 2021, and the impacts of the global pandemic’s effects on earnings.

Do You Know a MedTech Business in Need of Government Help During the COVID-19 Crisis?

If you know a US MedTech business that could still use a little help due to the COVID impacts, we have a listed a positive update on the SBA EIDL program on our website.

2019 - A Year in Review - M&A MedTech &LifeSciences

The healthcare industry is constantly evolving with large amounts of resources dedicated to R&D and the introduction of new technologies. Companies in this industry must keep up with the latest industry trends and standards as they risk becoming obsolete and losing market share. Only major players in the healthcare industry have the resources to rapidly invest in R&D or conduct acquisitions to keep pace with the market and stay ahead of the competition.

Global MedTech Industry M&A - Q1&Q2 2019 Review

We started to review MedTech's Global M&A activities in 2018 and received great feedback. So we are continuing again this year. Let's look at what happened during the 1st half of 2019:

MedTech Mindset: Bulls, Bears, and Tariffs, Oh my!

After years of continuous expansion, equity markets are experiencing volatility. Some are bearish in the near term while others remain bullish; and some of us don’t know which way the market will turn. The increasing use of tariffs as a blunt foreign policy instrument has increased uncertainty across all industries and the medical segment is no exception.

Overcoming Global Challenges for Success

There is no denying the innovative and disruptive nature of the Medtech industry, or its constant evolution. Success in this space has long depended largely on flexibility and a commitment to change, as reformation can help companies avoid obsolescence and extinction and enable them to capitalize on the sector’s projected 4.5 percent compound annual growth rate through 2023.

Keeping the Positive Momentum in Your Medtech Business in 2019

The medtech industry is in a state of disruption. Global industry dynamics and technology trends are creating both opportunity and confusion in the marketplace. This dichotomy naturally can lead to concerns over maintaining positive business momentum this year.

Analysis : MedDevices M&A Transactions 2018

The global medical device market is expected to reach an estimated $409.5 billion by 2023, and it is forecast to grow at a CAGR of 4.5% from 2018 to 2023. Technologies such as digital solutions, cloud solutions, remote care, and telehealth are few innovations driving the growth of the medical device and medical equipment industry.

2018 MedTech Deals Listing

2018 was a great year for MedTech M&A. We have gathered information from a number of sources to give the following report. Check out the full report.

2019 Preview: Predicting the Trends and Their Potential Impact on Business Plans

The prognosticators are at it again. With 2019 well underway, industry pundits are deeply ensconced in a longstanding New Year’s tradition—predicting the trends and developments likely to impact medtech over the next 12 months (and beyond).

A look back at 2018

2018 was another good year for M&A in Healthcare. Find below a summary of the main trends and numbers published to date: The Main Trends of 2018: Spurred on by tax relief, US companies used newly retained profits for acquisitions The US/ China Trade War slowed M&A transactions between the two countries.

Contact us.

We love what we do as we partner with our clients to bring them success. There are often many approaches to achieve your goals and will help you be successful. The best thing about our services is that YOU decide what YOU want to engage us for.

Connect with us for further details.

contact@medworldadvisors.com

(805) 441-0962

14616 78TH PL N

Loxahatchee, FL 33470